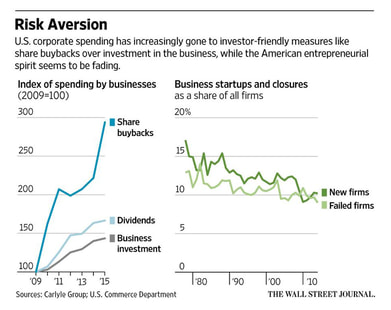

In a recent column, the Wall Street Journal’s chief economics commentator Greg Ip decried the cost of risk aversion. He presents a convincing case that risk aversion by corporate leaders is reducing investment which leads to reduced productivity and wages. He goes on to make the point that resources that should be invested in new technologies and products are instead being used to fund mergers and acquisitions, buy back shares, and pay dividends. Ip asserts that the impact goes beyond the future growth prospects of the companies. These executive are paid to lead. The resulting lower productivity and wages leads to “growing worker dissatisfaction and political upheaval.” Square in the cross hairs of this strategy is innovation which Ip artfully attributes to efficiently and creatively combining capital and labor. The impact of suppressing innovation is profound. Ip references New York University economist Paul Romer’s work in which he makes a fascinating observation: Unlike a machine or a worker, an idea, once conceived, can be reproduced and shared endlessly for free. The determinant of growth then is both how many ideas a society creates, and how quickly and efficiently they are distributed. Contemplate how many valuable ideas have not yet surfaces due to excessive risk aversion. Why are business decision-makers taking the more comfortable but ultimately less rewarding path? Beyond basic human nature that cherishes safety, Ip identifies a short-team mindset, the demands of activist investors, excessive government regulation and the challenge of getting sufficient returns on investments in technology. Who is doing it right? Who is allocating capital well so they do not suppress the future growth if the companies they have been selected to lead? Today, it is very hard to tell. A few years from now, it will be apparent. That will be when the bill for excessive risk aversion comes due. And in many cases, the executives who ran up the bill will be nowhere to be found.

0 Comments

|

Jim McCormickFounder and President Research Institute for Risk Intelligence Archives

April 2020

Categories |

RSS Feed

RSS Feed